MONEY TREE SHAKERS

Hi met, mi a beg you post dis pan jmg see if d bad ppl dem can roll out and tell me what it is demecia an har madda marcia do for a living… You know wah mek mi change dat mi waan no wah Demecia do for a living cah mi nuh tink marcia do nothin but siddung and wait pan man fi mind har… Dem love flass and show off money but mi really wah no where its comin from because no work attire/uniform nah show just bay posing and money.. florida ppl come eeeeeen.

AH MI DOOPS OO

Met this he/she deh pon Instagram and a flirt with all di dancehall man dem…lmao..but met when mi see none other than Kizzy man John John hit the like button pon the he/she pic every minute mi pause and start think back to when the meters dem talk seh him a (Edited)…mi nah laugh…check it out met it hot Like a whaaaa (jayx876)is John John IG name pon the last pic

MI JUS DROP DI LAST PICTURE…….ASHLEY A MI DOOPS *

ENGLAND ROUND 2

f+++ out ,rotten ole,shit up ole, suck p++,sharon a mi (beat chest) nicole (friend) send in yuh pic dem to JMG ano sheba r whoeva she want be, big p+++ gal u mek dem hold on pon mi fren but memba u affi cum a bloodclaat jamaica n mi ago shit up yuh bloodclaat a de airport and any weh mi see u mi a s+++ u up and u ago get a fine p++++ b+++ from mi and har family dem u ago see weh we do informer a jamaica,but look pon u weh a bay primark clothes u wear a nicole mek u start wear clothes wit name and u still a wear de china imitation dem yea u love buy de fake gucci and LV dem, u bad mind mi fren becus she av har assets dem sump weh u doe av except yuh clothes dem,u need fi shop sum weh better fi bigga so him look better,brazmite sharon u cum a jamaica and use de (Edited) money do belly and it doe do good u use dem money again do batty and dat neva do good it go inna yuh hip dem,u inna government house and yuh man nuffi live deh,hw much dat mi gone fi send (Edited) de two a unno days dem a shorten very quickly, sharon we knw u full up a bloodclaat mouth a action we deal wit mi ago (Edited), wen u a cum de date u a cum a jamaica me ago knw mi affi knw,tell batty boy bigga sey him must always remember weh him do and weh him work, and just fi mek yuh knw mi nuh partial pon NOBODY. Mi knw unno luv obeah but wen dem a dash back de obeah pon unno mi sorry fi unno nastiness cus a everybody fi unno a get it so all de gaurd u and bigga a put on it nah go save unno bomboclaat once more memba unno av three (Edited)

by de way a weh f+++ dis u av on dat cud neva be fish tail a must lobster tail r a de fish fin sharon u ugly nuh bloodclaaat enuh a de pic wen yuh black mi wan get a hold of mek dem see yuh hw u de beyond ugly to p++++,one more thing cover yuh face, wen bigga a beat u de next time

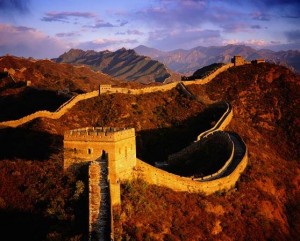

AFRICAN ”ECONOMIST” ON WHY CHINA IS GOOD FOR AFRICA….HA!

(CNN) — Zambian economist Dambisa Moyo is an outspoken critic of international aid, arguing for years that foreign handouts stifle Africa’s development, perpetuate corruption and hinder the continent’s growth.

A New York Times bestselling author, Moyo first grabbed international headlines with her 2009 book “Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa.”

Since then, she’s penned two more books, on the subject of the decline of the West, and the effects of China’s commodities rush.

In a new interview with CNN’s Robyn Curnow, Moyo explains why she’s optimistic about the future of Africa. She looks at the positive impact that China can have on the continent and details the key drivers that will spur Africa’s economic growth.

Foreign investors race for African land China’s economic influence in Africa Africans look for opportunities in China Immigration divides South Africa

An edited version of the interview follows.

CNN: The aid debate is so different from before …

Dambisa Moyo: So much has happened in the last five years — whether you’re in Africa, South America or Asia, nobody talks about aid anymore.

Policy makers themselves are going out and issuing debts in the market. My own country, Zambia, did a fantastic bond, a $750 million 10-year bond, last September. The discussion is so much more about job creation and investment, which is such a fantastic story and it’s obviously partly to do with the fact that the traditional donors are having a financial problem, fiscal problem, on their balance sheets. They just don’t have the capital anymore to hand out cash like they did in the past.

CNN: The Chinese story has been thrown into the mix, has that changed the landscape?

DM: Yes, absolutely, but in a strange way it’s exactly what we need in terms of delivering economic growth and meaningfully reducing poverty. We need jobs, we need investment, we need trade, we need foreign direct investment, whether investment domestically but also from the outside.

It’s not some magic pill, everybody knows that this is the formula, and finally the Chinese are showing up, again, not just in Africa, but around the world with that elixir, that mix of opportunities to really transform these countries. Remember, 70% of the populations of these places is under the age of 24. There is no escape: we have to create jobs.

Read this: How ‘Afropreneurs’ will shape Africa’s future

CNN: A lot of people are critical of Chinese “neo-colonialism” but you argue that’s not the case.

DM: Well, it’s not, because China has so many economic problems in itself. You know, this is a population of 1.3 billion people with 300 million people that live at the level of Western living style. So they’ve got a billion people to move out of poverty. The notion that they would be spending their time trying to colonize other places is just, frankly, absurd.

There is no escape; we have to create jobs.

Dambisa Moyo, economist

I’m not saying that China should be given a red carpet, carte blanche, to come into Africa or, indeed, anywhere in the world, and do what they like. We do need the investment, we need job creation and we do need actual trade in these places. But I think what’s really essential is to focus on what China can do for Africa, as well as what Africa can do for China. And I think that discussion is not had as objectively as it should be.

Ultimately, the responsibility of how China engages in Africa is really at the domain of the African governments. We would not be worried about the risks of neo-colonialism or abuse, environmental abuse and labor issues, if we trusted the African governments to do the right thing.

CNN: How do you see the trends playing out in the next decades?

DM: I’m an eternal optimist. I’m probably the wrong person to ask, because I do believe that the structural and fundamental structures of Africa right now are poised for a very good few decades. If you look at an economy through the lens of capital, which is basically money; labor, which is basically how many people do you have and what skills do they have; and productivity, which is just, how efficiently they use capital and labor, the trend is very clearly in favor of Africa.

Read this: African CEOs look to bright future

Ultimately, the responsibility of how China engages in Africa is really at the domain of the African governments.

Dambisa Moyo, economist

We’ve got a very solid fiscal story. The debt-to-GDP ratios in Africa today at the sovereign level are nowhere near the burdens that we are seeing in Europe and the United States.

The labor story is very positive — 60-70% of Africans are under the age of 25. So a young population dynamically needs to be leveraged, so definitely we need to invest in skills and education to make sure that we get the best out of this young population. And then, in terms of productivity, this continent is a great absorber of technologies and all the things that can help us become more efficient.

Therefore, these three key drivers: capital, labor, and productivity, help spur economic growth.

Now is it going to be smooth sailing? Of course not — there will be volatility, but I think the real investors in Africa will be able to make a delineation between risk and uncertainty.

CNN: And it’s about a country’s resources, too, right?

DM: That’s a brilliant question, because actually the answer is no. I think it’s really about the structural things that I mentioned: capital, labor, productivity.

Why do I say that? Let’s take a look at the African stock market. There are about 20 stock exchanges in Africa and about 1,000 stocks that trade in Africa — 85% of them are non-commodities. We’re talking about banking, we’re talking about insurance, we’re talking about retail, we’re talking about consumer goods, logistics companies, telecommunications companies, those are the stocks that are on the African stock market.

CNN: Do you feel a sense of responsibility to represent the African success story?

DM: Well, I suppose, for me, I feel a responsibility to tell the truth. This is a great continent. I went to primary school on this continent, secondary school, university, I’ve worked on this continent and I think that it’s a great disservice that, for whatever reason, people have usurped an imagery of Africa that is absolutely incorrect.

They focus on war, disease, corruption and poverty. That is not all about Africa and I think it’s really essential if we’re going to turn the corner, we need to take that responsibility, as governments, as citizens, not just Africans, global citizens to say, “that’s actually not true.”

There are more poor people in India than there are in Africa; more poor people in China than there are in Africa, but somehow there’s a stigma for decades that’s been associated with the African continent that is completely unjustified — and it’s that I find objectionable.

AYE SAH- CHINA AND DI HACKING

As Hacking Against U.S. Rises, Experts Try to Pin Down Motive

By NICOLE PERLROTH, DAVID E. SANGER and MICHAEL S. SCHMIDT

Published: March 3, 2013

SAN FRANCISCO — When Telvent, a company that monitors more than half the oil and gas pipelines in North America, discovered last September that the Chinese had hacked into its computer systems, it immediately shut down remote access to its clients’ systems.

Related

News Analysis: In Cyberspace, New Cold War (February 25, 2013)

Connect With Us on Twitter

Follow @NYTNational for breaking news and headlines.

Twitter List: Reporters and Editors

Company officials and American intelligence agencies then grappled with a fundamental question: Why had the Chinese done it?

Was the People’s Liberation Army, which is suspected of being behind the hacking group, trying to plant bugs into the system so they could cut off energy supplies and shut down the power grid if the United States and China ever confronted each other in the Pacific? Or were the Chinese hackers just trolling for industrial secrets, trying to rip off the technology and pass it along to China’s own energy companies?

“We are still trying to figure it out,” a senior American intelligence official said last week. “They could have been doing both.”

Telvent, which also watches utilities and water treatment plants, ultimately managed to keep the hackers from breaking into its clients’ computers.

At a moment when corporate America is caught between what it sees as two different nightmares — preventing a crippling attack that brings down America’s most critical systems, and preventing Congress from mandating that the private sector spend billions of dollars protecting against that risk — the Telvent experience resonates as a study in ambiguity.

To some it is prime evidence of the threat that President Obama highlighted in his State of the Union address, when he warned that “our enemies are also seeking the ability to sabotage our power grid, our financial institutions, our air traffic control systems,” perhaps causing mass casualties. Mr. Obama called anew for legislation to protect critical infrastructure, which was killed last year by a Republican filibuster after intensive lobbying by the Chamber of Commerce and other business groups.

But the security breach of Telvent, which the Chinese government has denied, also raises questions of whether those fears — the subject of weekly research group reports, testimony and Congressional studies — may be somewhat overblown, or whether the precise nature of the threat has been misunderstood.

American intelligence officials believe that the greater danger to the nation’s infrastructure may not even be China, but Iran, because of its avowal to retaliate for the Stuxnet virus created by the United States and Israel and unleashed on one of its nuclear sites. But for now, these officials say, that threat is limited by gaps in Iranian technical skills.

There is no doubt that attacks of all kinds are on the rise. The Department of Homeland Security has been responding to intrusions on oil pipelines and electric power organizations at “an alarming rate,” according to an agency report last December. Some 198 attacks on the nation’s critical infrastructure systems were reported to the agency last year, a 52 percent increase from the number of attacks in 2011.

Researchers at McAfee, a security firm, discovered in 2011 that five multinational oil and gas companies had been attacked by Chinese hackers. The researchers suspected that the Chinese hacking campaign, which they called Night Dragon, had affected more than a dozen companies in the energy industry. More recently, the Department of Energy confirmed in January that its network had been infiltrated, though it has said little about what damage, if any, was done.

But security researchers say that the majority of those attacks were as ambiguous as the Telvent case. They appeared to be more about cyberespionage, intended to bolster the Chinese economy. If the goal was to blow up a pipeline or take down the United States power grid, the attacks would likely have been of a different nature.

In a recent report, Critical Intelligence, an Idaho Falls security company, said that several cyberattacks by “Chinese adversaries” against North American energy firms seemed intended to steal fracking technologies, reflecting fears by the Chinese government that the shale energy revolution will tip the global energy balance back in America’s favor. “These facts are likely a significant motivation behind the wave of sophisticated attacks affecting firms that operate in natural gas, as well as industries that rely on natural gas as an input, including petrochemicals and steelmaking,” the Critical Intelligence report said, adding that the attack on Telvent, and “numerous” North American pipeline operators may be related.

American intelligence experts believe that the primary reason China is deterred from conducting an attack on infrastructure in the United States is the simple economic fact that anything that hurts America’s financial markets or transportation systems would also have consequences for its own economy. It could interrupt exports to Walmart and threaten the value of China’s investments in the United States — which now include a new, big investment in oil and gas.

Iran, however, may be a different threat. While acknowledging that “China is stealing our intellectual property at a rate that qualifies as an epidemic,” Representative Mike Rogers, the Michigan Republican who chairs the House Intelligence Committee, added a caveat in an interview on Friday. “China is a rational actor,” he said. “Iran is not a rational actor.”

A new National Intelligence Estimate — a classified document that has not yet been published within the government, but copies of which are circulating for final comments — identifies Iran as one of the other actors besides China who would benefit from the ability to shut down parts of the American economy. Unlike the Chinese, the Iranians have no investments in the United States. As a senior American military official put it, “There’s nothing but upside for them to go after American infrastructure.”

While the skills of Iran’s newly created “cybercorps” are in doubt, Iranian hackers gained some respect in the technology community when they brought down 30,000 computers belonging to Saudi Aramco, the world’s largest oil producer, last August, replacing their contents with an image of a burning American flag.

The attack did not affect production facilities or refineries, but it made its point.

“The main target in this attack was to stop the flow of oil and gas to local and international markets and thank God they were not able to achieve their goals,” Abdullah al-Saadan, Aramco’s vice president for corporate planning, told Al Ekhbariya television.

President Obama has been vague about how the United States would respond to such an attack. No one in the administration argues that the United States should respond with cyber- or physical retaliation for the theft of secrets. Attorney General Eric H. Holder Jr. has made clear that would be dealt with in criminal courts, though the prosecutions of cybertheft by foreign sources have been few.

But the question of whether the president could, or should, order military retaliation for major attacks that threaten the American public is a roiling debate.

“Some have called for authorizing the military to defend private corporate networks and critical infrastructure sectors, like gas pipelines and water systems,” Candace Yu, who studies the issue for the Truman National Security Project, wrote recently. “This is unrealistic. The military has neither the specialized expertise nor the capacity to do this; it needs to address only the most urgent threats.”

But the administration has failed to convince Congress that the first line of defense to avert catastrophic cyberattack is to require private industry — which controls the cellphone networks and financial and power systems that are the primary target of infrastructure attacks — that it must build robust defenses.

A bill containing such requirements was defeated last year amid intense lobbying from the United States Chamber of Commerce and others, which argued that the costs would be prohibitive. Leading members of Congress say they expect the issue will come up again in the next few months.

“We are in a race against time,” Michael Chertoff, the former secretary of homeland security, said last week. “Most of the infrastructure is in private hands. The government is not going to be able to manage this like the air traffic control system. We’re going to have to enlist a large number of independent actors.”

The administration’s cybersecurity legislation last year failed despite closed-door simulations for lawmakers about what a catastrophic attack would look like.

During one such simulation that the Department of Homeland Security allowed a New York Times reporter to view at a department facility in Virginia, a woman played the role of an “evil hacker” who successfully broke into a power plant’s network. To get in, the hacker used a method called “spearphishing,” in which she sent a message to a power plant employee that induced the employee to click on a link to see pictures of “cute puppies.”

When the employee clicked on the link, it surreptitiously allowed the hacker to gain access to the employee’s computer, enabling her to easily turn the switches to the plant’s breakers on and off.

Although the officials providing the briefing acknowledged that the simulation was a bit simplistic, their message was clear: with so many vulnerable critical infrastructure systems across the country, such an attack could easily occur, with huge consequences. No one rules out that scenario — whatever the current motivations and abilities of countries like China and Iran.

“There are 12 countries developing offensive cyberweapons; Iran is one of them,” James Lewis, a former government official and cybersecurity expert at the Center for Strategic and International Studies in Washington, said at a security conference in San Francisco. Those countries have a long way to go, he said, but added: “Like nuclear weapons, eventually they’ll get there.”

Nicole Perlroth and Michael S. Schmidt reported from San Francisco, and David E. Sanger from Washington.

****RULES**** 1. Debates and rebuttals are allowed but disrespectful curse-outs will prompt immediate BAN 2. Children are never to be discussed in a negative way 3. Personal information eg. workplace, status, home address are never to be posted in comments. 4. All are welcome but please exercise discretion when posting your comments , do not say anything about someone you wouldnt like to be said about you. 5. Do not deliberately LIE on someone here or send in any information based on your own personal vendetta. 6. If your picture was taken from a prio site eg. fimiyaad etc and posted on JMG, you cannot request its removal. 7. If you dont like this forum, please do not whine and wear us out, do yourself the favor of closing the screen- Thanks! . To send in a story send your email to :- [email protected]

Recent Comments